Annual Bonus Calculator

Bonus Calculation Result

Annual Bonus Calculator: Maximize Your Bonus Potential

Our Annual Bonus Calculator is here to help you estimate your annual bonus with ease. Designed for professionals who want clarity on their yearly bonus, this calculator factors in performance and tax rates to give you an accurate net bonus amount after deductions.

What is an Annual Bonus?

An annual bonus is a financial reward typically given to employees based on performance, company profits, or a combination of factors. Many companies offer bonuses to recognize hard work and motivate employees to achieve more. Understanding how bonuses are calculated can help you plan your finances effectively.

Why Use an Annual Bonus Calculator?

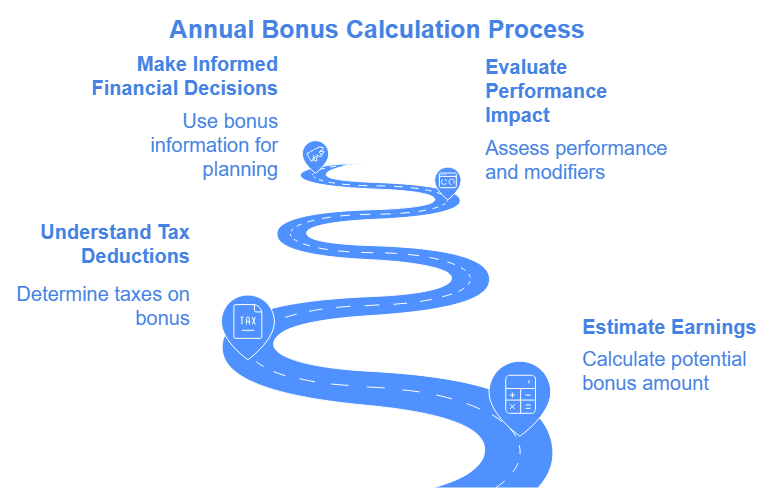

With this Annual Bonus Calculator, you can:

- Estimate Your Earnings: Get a clear picture of your bonus before it arrives, so you can plan financially.

- Understand Tax Deductions: Calculate the taxes on your bonus to understand your net earnings.

- Evaluate Performance Impact: See how your performance and company modifiers affect your total bonus.

- Make Informed Financial Decisions: Knowing your bonus amount helps in budgeting, saving, or making big purchases.

How to Use the Annual Bonus Calculator

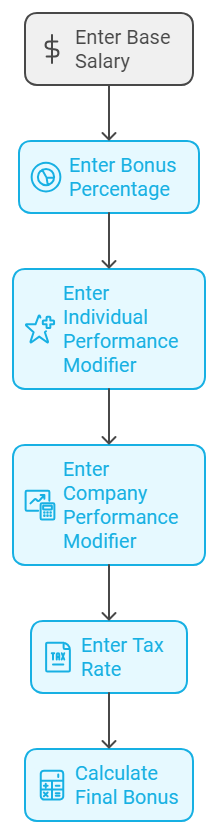

Using our Annual Bonus Calculator is straightforward. Here’s what you’ll need to enter:

- Base Salary ($): Enter your annual base salary. This serves as the foundation for calculating your bonus.

- Bonus Percentage (%): This percentage is typically set by your employer based on role and performance expectations.

- Individual Performance Modifier (1-2): Input your performance rating, typically between 1 (standard) and 2 (high achiever).

- Company Performance Modifier (1-2): Reflects the overall company performance for the year.

- Tax Rate (%): Input the tax rate that will be withheld from your bonus, which may vary depending on your location.

After inputting these values, click “Calculate Bonus” to view the following:

- Gross Bonus: The bonus before tax deductions.

- Tax Withholding: The amount deducted for taxes.

- Net Bonus: The actual bonus amount you’ll receive after taxes.

Benefits of the Annual Bonus Calculator

With our Calculator, you’ll know exactly what to expect from your bonus. This helps you make confident financial decisions, whether you’re planning a major purchase, saving for the future, or budgeting for the year ahead.

Plan for Your Future with the Annual Bonus Calculator

Taking charge of your finances has never been easier. Use our Annual Bonus Calculator to see how your performance, company goals, and tax obligations impact your bonus. Make the most of your hard-earned reward by planning ahead with this tool. Calculate today and step confidently into financial clarity!

Frequently Asked Questions (FAQ)

The Annual Bonus Calculator is a tool that helps you estimate your annual bonus based on your base salary, bonus percentage, performance modifiers, and tax rate.

To use this calculator, enter your base salary, bonus percentage, individual and company performance modifiers, and tax rate. Click “Calculate Bonus” to see your gross bonus, tax amount, and net bonus.

You need to provide your base salary, bonus percentage, individual performance modifier, company performance modifier, and tax rate for bonus calculations.

The gross bonus is calculated using this formula: Gross Bonus = Base Salary × Bonus Percentage × Individual Performance Modifier × Company Performance Modifier. The tax amount is deducted to provide the net bonus.

Yes, this calculator is completely free to use and provides a quick estimate of your annual bonus without any cost.