Gold Bond Investment Calculator – India

Gold Bond Investment Calculator – india

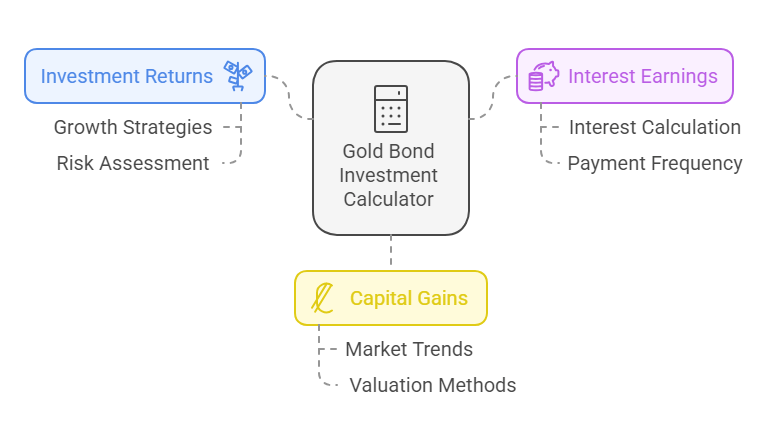

Investing in gold bonds is a secure and profitable way to grow your wealth while hedging against inflation and market volatility. With the Gold Bond Investment Calculator – India, you can easily estimate your returns, understand the interest earned, and evaluate the potential capital gains from your investment. This tool is designed to help Indian investors make informed decisions when investing in Sovereign Gold Bonds (SGBs).

How to Use the Gold Bond Investment Calculator:

- Enter Your Investment Amount: Input the amount (₹) you plan to invest in gold bonds.

- Gold Price Per Gram: Provide the current market price of gold per gram. This is crucial for calculating the quantity of gold your investment will purchase.

- Interest Rate: The typical annual interest rate for SGBs is 2.5%. You can adjust this field as needed.

- Tenure (Years): Sovereign Gold Bonds generally have an 8-year maturity period. Enter your investment duration here.

- Estimated Gold Price at Maturity: Predict the gold price per gram at the end of the bond’s tenure. This helps determine your capital gains.

Key Features:

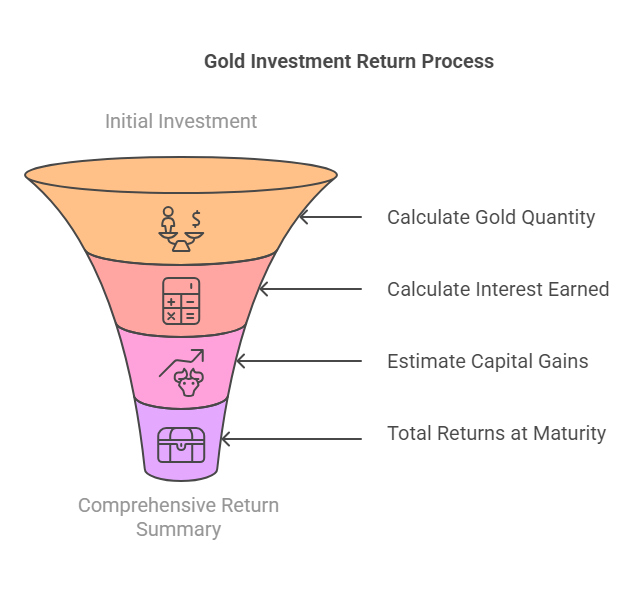

- Gold Quantity Calculation: The calculator determines how many grams of gold your investment can purchase.

- Interest Earned: Find out how much interest you’ll earn over the chosen tenure, based on the fixed annual rate.

- Capital Gains Estimation: Calculate the potential profit from the increase in gold prices over time.

- Total Returns at Maturity: View a comprehensive breakdown of your total returns, including principal, interest, and capital gains.

Why Choose Gold Bonds in India?

Sovereign Gold Bonds are issued by the Reserve Bank of India (RBI) on behalf of the government, offering a reliable alternative to physical gold. Key benefits include:

- Fixed Interest Income: Earn annual interest in addition to potential price appreciation.

- Tax Benefits: Capital gains tax is exempt if held until maturity, making it a tax-efficient investment.

- No Storage Worries: Unlike physical gold, SGBs eliminate the risk of theft or storage costs.

Example Scenario:

Imagine you invest ₹5,00,000 in gold bonds when the gold price is ₹5,000 per gram. Over an 8-year tenure, with a 2.5% annual interest rate, and an estimated gold price of ₹7,500 per gram at maturity, your investment would yield:

- Gold Quantity: 100 grams

- Interest Earned: ₹1,00,000

- Capital Gains: ₹2,50,000

- Total Returns: ₹8,50,000

Benefits of Using This Tool:

The Gold Bond Investment Calculator – India simplifies your financial planning process, ensuring you have a clear understanding of your investment’s performance. It’s perfect for investors seeking transparency and accuracy in their gold bond investments.

Start using the Gold Bond Investment Calculator today and make the most of your gold bond investments in India!