Leveraged ETF Calculator

Understanding Leveraged ETFs: Simplify Your Investments with a Leveraged ETF Calculator

Leveraged ETFs are a powerful yet complex financial tool that allows investors to amplify returns on their initial investments. Whether you’re a seasoned investor or just exploring leveraged trading, our Leveraged ETF Calculator is designed to help you understand how leveraging works and how it impacts your investments.

What Is a Leveraged ETF?

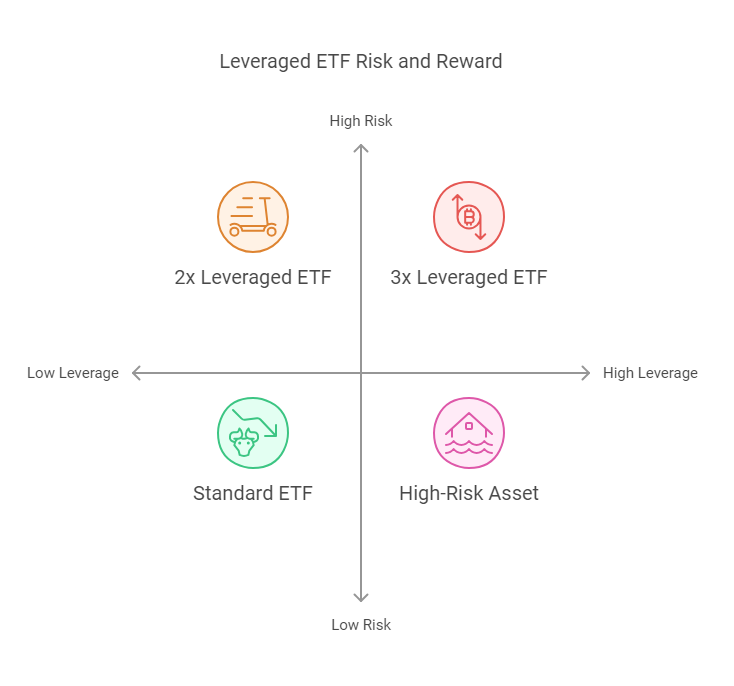

A leveraged ETF (Exchange-Traded Fund) uses financial derivatives and debt to multiply the returns of an underlying index. These ETFs are typically available in 2x, 3x, or even higher leverage ratios, meaning they aim to double, triple, or otherwise amplify the daily performance of an index. However, this also means that losses can be magnified in the same proportion.

For example, if an index gains 5% in a day, a 2x leveraged ETF would aim to achieve a 10% return. Conversely, if the index loses 5%, the ETF would incur a 10% loss.

Why Use the Leveraged ETF Calculator?

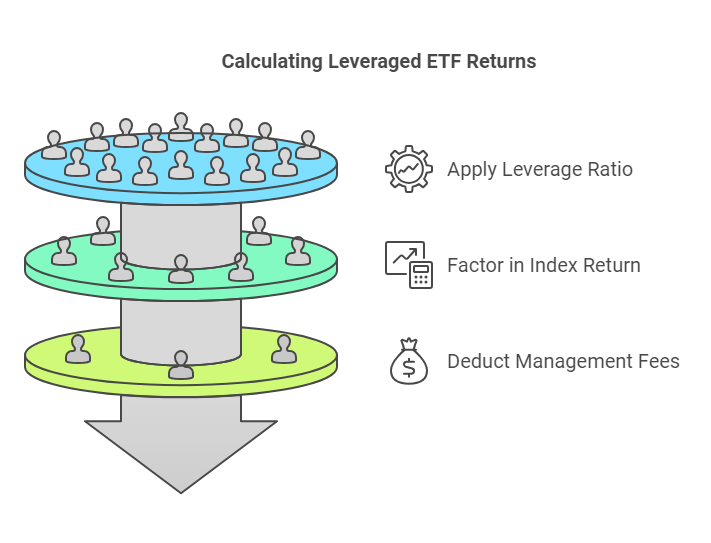

Investing in leveraged ETFs requires careful planning, as returns are influenced by multiple factors, including:

- Initial Investment Amount: Your starting capital.

- Leverage Ratio: The multiplier effect (e.g., 2x, 3x).

- Underlying Index Return: The percentage change in the benchmark index.

- Management Fees: Ongoing fees charged by the ETF provider, which can impact net returns.

With this calculator, you can determine how much your investment would grow or shrink under varying conditions. By inputting key parameters, you can instantly see both your leveraged return and the net return after management fees.

How to Use the Leveraged ETF Calculator

- Initial Investment ($): Enter your starting capital.

- Leverage Ratio: Specify the ETF’s leverage (e.g., 2 for 2x, 3 for 3x).

- Underlying Index Return (%): Input the expected percentage change in the index (positive or negative).

- Annual Management Fee (%): Provide the ETF’s management fee percentage.

Click the Calculate button, and the tool will display:

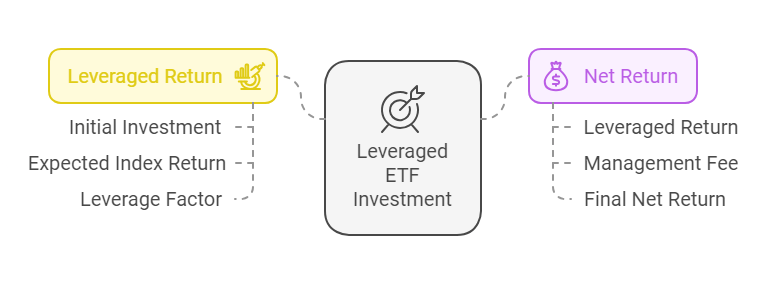

- Leveraged Return: The amplified return before fees.

- Net Return (After Fees): Your return after accounting for management fees.

Example Calculation

Suppose you invest $10,000 in a 2x leveraged ETF with an expected index return of 10% and an annual management fee of 0.5%.

- Leveraged Return: $10,000 × (1 + 2 × 0.10) = $12,000.

- Net Return: $12,000 – ($10,000 × 0.005) = $11,950.

Benefits of Using a Leveraged ETF Calculator

- Simplifies Decision-Making: Quickly estimate potential gains or losses.

- Risk Assessment: Understand how management fees and leverage affect returns.

- Planning Tool: Use real-world data to make informed investment choices.

Important Considerations

While leveraged ETFs can provide significant short-term gains, they are not designed for long-term investments due to the compounding effect of daily returns. Investors should carefully evaluate their risk tolerance, market conditions, and goals before investing.

Explore the potential of leveraged ETFs today with our Leveraged ETF Calculator, and make smarter, data-driven investment decisions!