Portfolio Variance Calculator

Portfolio Variance Calculator: Optimize Your Investment Strategy

Welcome to our Portfolio Variance Calculator, your go-to tool for analyzing the risk and performance of your investment portfolio. Understanding portfolio variance is crucial for investors aiming to achieve the best risk-return balance in their asset allocation strategies. This calculator allows you to assess how different assets interact and their combined effect on portfolio risk.

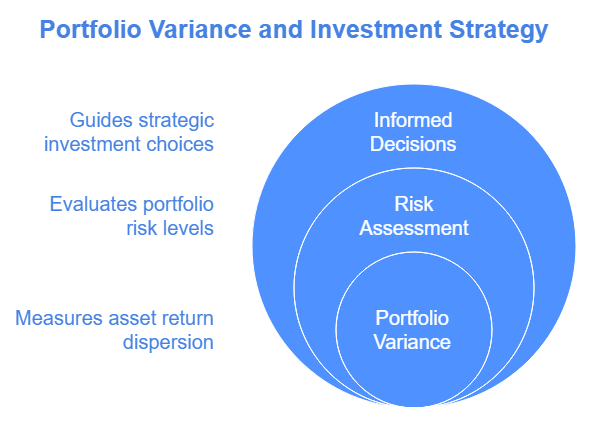

What is Portfolio Variance?

Portfolio variance measures the dispersion of returns for a set of investments in a portfolio. It quantifies how much the returns of your assets vary together, which is essential for understanding the overall risk of your portfolio. A higher variance indicates a greater risk, while a lower variance suggests more stability.

In essence, the Portfolio Variance Calculator helps you determine how well your assets work together, enabling you to make informed decisions about your investments.

Why Use the Portfolio Variance Calculator?

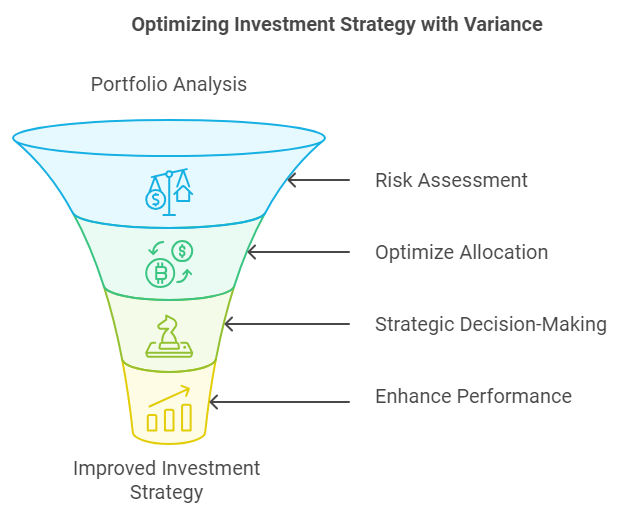

Our Portfolio Variance Calculator offers several advantages:

- Risk Assessment: Evaluate the overall risk associated with your investment strategy by analyzing how different assets correlate.

- Optimize Asset Allocation: By understanding variance, you can create a well-balanced portfolio that aligns with your risk tolerance and investment goals.

- Strategic Decision-Making: Armed with variance insights, investors can make data-driven decisions about buying, selling, or reallocating assets.

- Enhance Portfolio Performance: Identify opportunities to reduce risk while maintaining or improving expected returns.

How to Use the Portfolio Variance Calculator

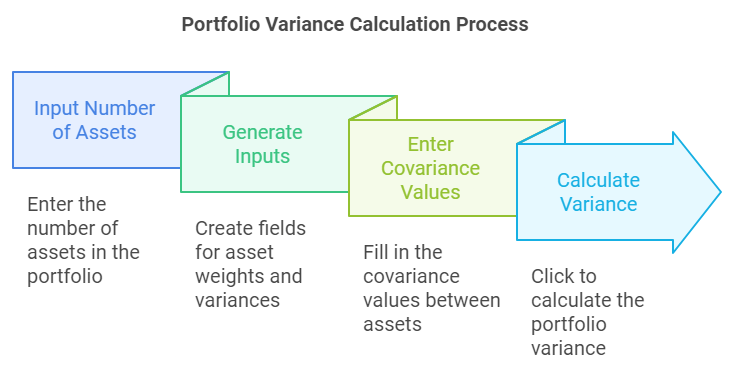

Using our Portfolio Variance Calculator is simple and intuitive:

- Input Number of Assets:

Enter the number of assets in your portfolio (minimum of 2). This step helps set up the necessary fields for your assets. - Generate Inputs:

Click the “Generate Inputs” button to create fields for entering the weights and variances of each asset. Each asset’s weight reflects its proportion in your portfolio, while variance represents its risk. - Enter Covariance Values:

After generating inputs, fill in the covariance values between the assets. Covariance measures how two assets move together and is crucial for calculating overall portfolio risk. - Calculate Variance:

Once you’ve filled out all required fields, click “Calculate Portfolio Variance” to obtain the results.

Understanding Your Results

Upon calculation, the Portfolio Variance Calculator will display:

- Portfolio Variance: This value represents the overall risk associated with your investment portfolio. A lower variance indicates a more stable portfolio, while a higher variance points to greater risk.

Take Control of Your Investment Risk

The Portfolio Variance Calculator is an essential tool for investors seeking to optimize their investment strategies. By analyzing the variance of your portfolio, you can make informed decisions that align with your financial objectives and risk tolerance.

Start Calculating Today!

Don’t leave your investment decisions to chance. Use our Portfolio Variance Calculator to gain valuable insights into your portfolio’s risk profile. Whether you are a seasoned investor or just starting, understanding variance will empower you to make smarter investment choices. Begin calculating now and enhance your investment strategy!

Frequently Asked Questions (FAQ)

The Portfolio Variance Calculator is a tool that helps users calculate the variance of a portfolio based on the weights, variances, and covariances of its individual assets.

To use the calculator, enter the number of assets, then specify the weight and variance for each asset. Finally, input the covariance values and click “Calculate Portfolio Variance” to get the result.

You need to provide the number of assets, weights, variances for each asset, and the covariance values in a symmetric matrix format.

Portfolio variance is calculated using the formula: Variance = Σ(Weight_i * Weight_j * Covariance_ij), where the summation runs over all assets in the portfolio.

Yes, this calculator is completely free to use, providing a straightforward way to calculate portfolio variance without any costs involved.